IRS $8700 Stimulus Check Eligibility Criteria

Irs 00 stimulus check irs gov – To receive the $8700 stimulus check, individuals must meet certain income limits and other eligibility requirements set by the IRS. These criteria ensure that the funds are distributed fairly and effectively to those who need financial assistance.

The much-awaited IRS $8700 stimulus check from irs.gov is still being processed, and many individuals are eagerly anticipating its arrival. While we wait, let’s take a moment to appreciate the remarkable legacy of Roy Campanella, a legendary baseball player whose determination and resilience on the field are an inspiration to us all.

His exceptional skills and contributions to the sport are a testament to the indomitable spirit that resides within us. As we continue to navigate these challenging times, may the story of Roy Campanella serve as a beacon of hope and remind us that even amidst adversity, the IRS $8700 stimulus check will eventually make its way to those who need it most.

Income Limits

The eligibility for the $8700 stimulus check is primarily based on income limits. Individuals with adjusted gross income (AGI) below certain thresholds qualify for the full amount. The income thresholds vary depending on the taxpayer’s filing status.

I was browsing the IRS website for information on the $8700 stimulus check, when I came across a link to buena vista ga. I’m not sure why it was there, but I clicked on it anyway. The website had some interesting information about the town, including its history, population, and local businesses.

I also found out that Buena Vista is home to a number of historical landmarks, including the Buena Vista Battlefield and the Buena Vista Train Depot. After browsing the website for a while, I went back to the IRS website and continued my search for information on the stimulus check.

| Filing Status | Income Threshold |

|---|---|

| Single | $75,000 |

| Married Filing Jointly | $150,000 |

| Head of Household | $112,500 |

| Married Filing Separately | $75,000 |

Individuals with AGI above these thresholds may still receive a reduced stimulus check amount. However, the amount will be gradually phased out as income increases.

Other Eligibility Requirements

In addition to income limits, individuals must also meet the following eligibility requirements to receive the $8700 stimulus check:

- Be a U.S. citizen or resident alien

- Have a valid Social Security number

- Not be claimed as a dependent on someone else’s tax return

- Have filed a 2019 or 2020 tax return (or be eligible to file)

Individuals who meet all of these eligibility criteria are eligible to receive the $8700 stimulus check from the IRS.

IRS $8700 Stimulus Check Payment Details

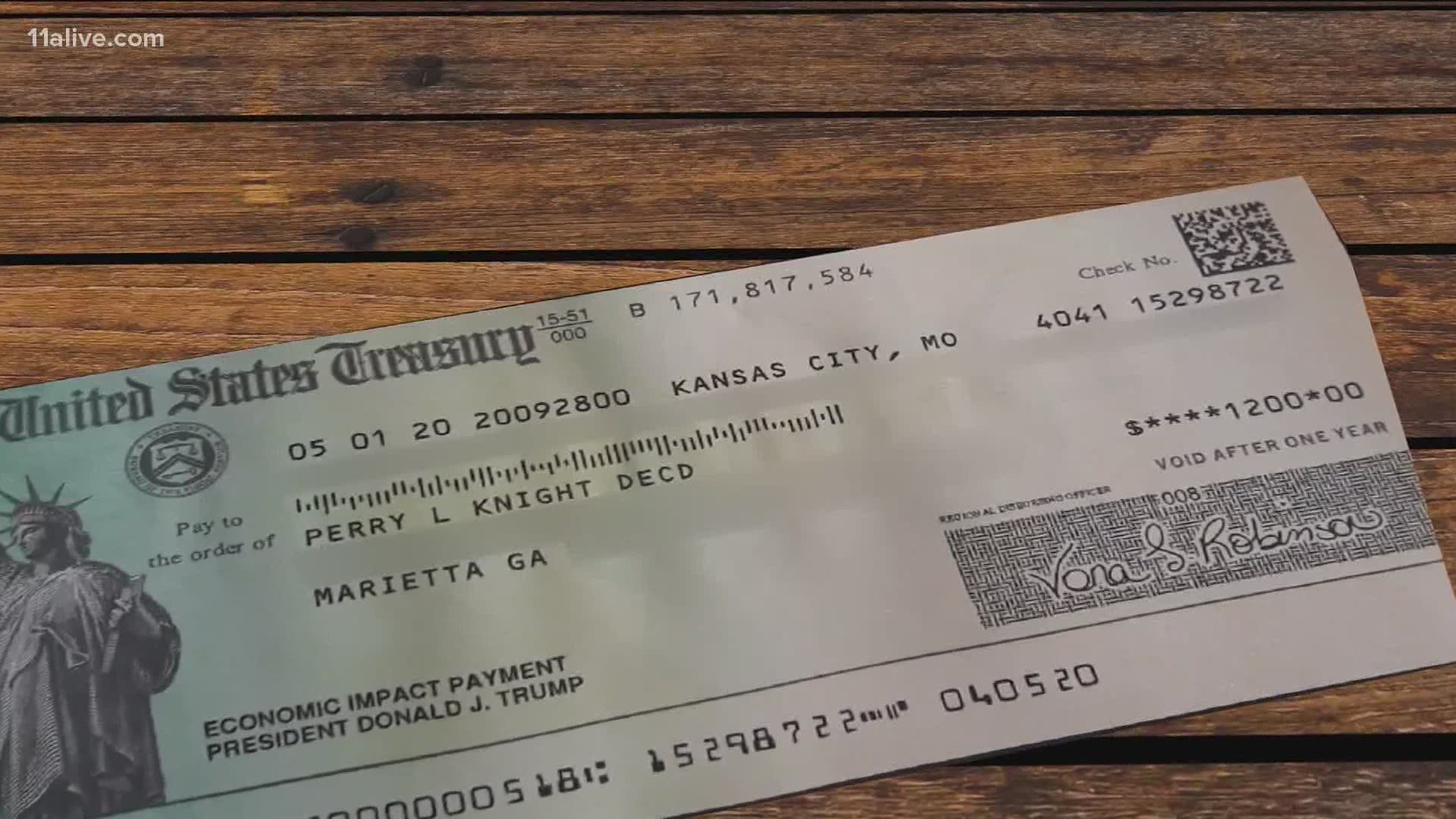

The IRS will issue the $8700 stimulus checks through three primary methods: direct deposit, paper check, and EIP Card. The majority of eligible recipients will receive their payments via direct deposit, which will be sent to the bank account on file with the IRS. For those who do not have direct deposit information on file, a paper check will be mailed to the address the IRS has on record. The EIP Card is a prepaid debit card that will be mailed to eligible recipients who have not received their payment by direct deposit or paper check.

The IRS has not yet announced a specific timeline for when payments will be issued. However, the agency has stated that it plans to begin sending out payments in early 2023.

Direct Deposit

Direct deposit is the fastest and most convenient way to receive your stimulus check. If you have not already provided the IRS with your direct deposit information, you can do so by filing a tax return or using the IRS’s online portal.

Paper Check

Paper checks will be mailed to eligible recipients who do not have direct deposit information on file with the IRS. The IRS has not yet announced when paper checks will be mailed, but it is expected that they will begin arriving in early 2023.

EIP Card

The EIP Card is a prepaid debit card that will be mailed to eligible recipients who have not received their payment by direct deposit or paper check. The EIP Card can be used to make purchases, withdraw cash, and check your balance.

IRS $8700 Stimulus Check Frequently Asked Questions: Irs 00 Stimulus Check Irs Gov

This section provides answers to common questions about the IRS $8700 stimulus check, including eligibility, claiming the payment, and troubleshooting issues.

Eligibility

- Who is eligible for the stimulus check? US citizens and resident aliens with a valid Social Security number who meet the income requirements.

- What are the income requirements? For individuals, the adjusted gross income (AGI) must be below $75,000; for married couples filing jointly, the AGI must be below $150,000.

- Can dependents receive a stimulus check? No, dependents are not eligible for a stimulus check.

Claiming the Payment

- How do I claim the stimulus check? Most eligible individuals will receive the payment automatically. No action is required.

- What if I haven’t received my stimulus check? You can check the status of your payment on the IRS website or by calling the IRS at 1-800-829-1040.

- Can I track the status of my stimulus check? Yes, you can track the status of your payment on the IRS website or by calling the IRS at 1-800-829-1040.

Troubleshooting Issues, Irs 00 stimulus check irs gov

- What if I am eligible but did not receive a stimulus check? You can file a recovery rebate credit on your 2020 tax return to claim the payment.

- What if I received a stimulus check but I am not eligible? You will need to repay the IRS the amount of the payment.

- What if I have questions about the stimulus check? You can visit the IRS website or call the IRS at 1-800-829-1040.

The irs $8700 stimulus check irs gov is a topic that has been in the news a lot lately. Many people are wondering if they are eligible for the check and how to claim it. The irs $8700 stimulus check irs gov is a one-time payment that will be sent to eligible individuals.

The amount of the check will vary depending on your income and filing status. If you are eligible for the check, you will receive it automatically. However, you may need to file a tax return to claim the check. For more information on the irs $8700 stimulus check irs gov, please visit the IRS website.

Juan Soto is a professional baseball player who plays for the Washington Nationals. Soto is one of the most promising young players in baseball and is considered to be one of the best hitters in the league. Soto has won several awards, including the Silver Slugger Award and the Rookie of the Year Award.

He is also a member of the Dominican Republic national baseball team. The irs $8700 stimulus check irs gov is a one-time payment that will be sent to eligible individuals.

The IRS has been hard at work distributing stimulus checks to eligible Americans, with the latest round of payments totaling $8,700. As you eagerly await your check, take a moment to learn about the all-time home run leaders, who have left an indelible mark on the sport.

Babe Ruth, Hank Aaron, and Barry Bonds are just a few of the legendary players who have etched their names into baseball history. Explore the all-time home run leaders and discover the remarkable achievements of these baseball icons. While you delve into the world of home runs, don’t forget to check the IRS website for updates on the status of your $8,700 stimulus check.

I’m so excited to finally receive my IRS $8700 stimulus check! I’ve been waiting for this for months, and I’m planning to use it to pay off some bills and save for the future. I’m also thinking about using some of it to buy a new pair of shoes, because I’ve been eyeing a pair of Steph Curry’s new sneakers.

I know he recently requested a trade , but I’m still a huge fan. I’m hoping he’ll stay with the Warriors, but I’ll still be rooting for him no matter where he goes. Anyway, back to the stimulus check – I’m so grateful for this extra money, and I’m going to put it to good use.